In the complex world of healthcare finance, payment posting in medical billing serves as the backbone of a practice’s revenue cycle management. This critical process ensures that every dollar collected—whether from insurance companies or patients—is accurately recorded and reconciled against outstanding claims. Without proper payment posting, medical practices risk financial disarray, delayed reimbursements, and frustrated patients.

What Is Payment Posting in Medical Billing?

Payment posting is the systematic process of recording and applying payments received from various sources into a medical practice’s billing system. This includes insurance payments, patient payments, and adjustments. Think of it as the financial bridge between providing healthcare services and maintaining an accurate picture of your practice’s revenue stream.

The medical billing payment processing workflow begins when a payment arrives—whether as a check in the mail, an electronic transfer, or a patient’s credit card swipe at checkout. Each payment must be meticulously matched to the correct patient account, specific claim, and individual service rendered.

The Payment Posting Process: Step by Step

The payment posting process follows a structured pathway that ensures financial accuracy and accountability. First, payments are received and identified by source. Insurance payments typically arrive with detailed documentation, while patient payments may require additional verification steps.

Next comes the critical matching phase. Staff members or automated systems locate the corresponding patient account and identify which specific claim or service the payment addresses. This matching process requires attention to detail, as a single patient may have multiple outstanding claims across different dates of service.

Once matched, the payment is entered into the billing system with all relevant details: payment amount, date received, payer identification, and any adjustments or denials. The system then updates the patient’s account balance, aging reports, and overall accounts receivable posting records.

Insurance Payment Posting: Navigating Complexity

Insurance payment posting represents one of the most intricate aspects of medical billing. Insurance companies don’t simply send a check with a thank-you note. Instead, they provide detailed remittances that explain exactly what they’re paying, what they’re denying, and why.

Understanding insurance remittance posting requires familiarity with payment codes, adjustment reasons, and contractual obligations. Each line item posting must reflect not just the payment received but also any contractual adjustments, patient responsibility transfers, and denial reasons.

Insurance companies often bundle multiple claims into a single payment, requiring meticulous unbundling to ensure each service is properly credited. Missing this step can lead to duplicate billing attempts or inaccurate patient statements.

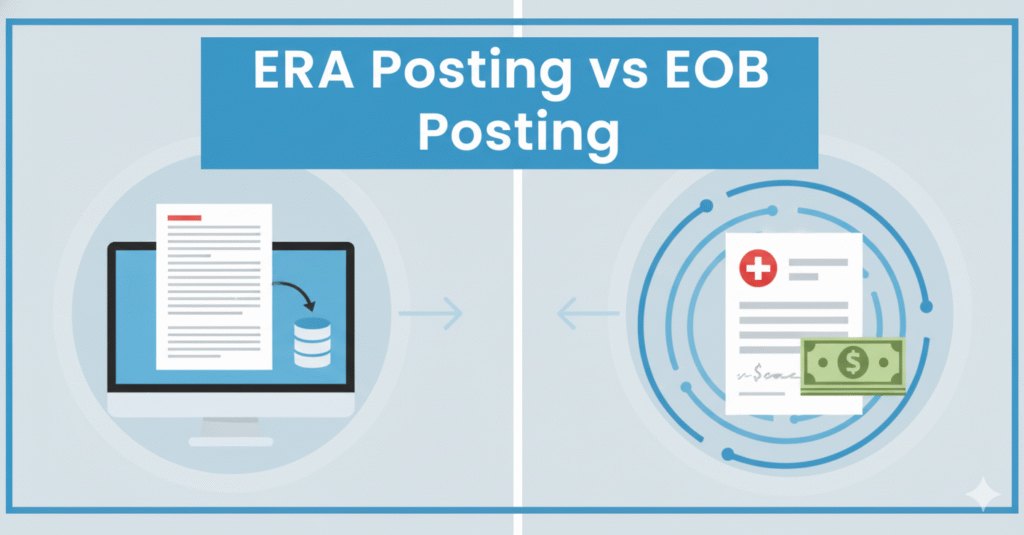

ERA Posting vs EOB Posting: Digital vs Traditional

Modern medical practices face a choice between two primary methods of handling insurance payments: ERA posting and EOB posting.

Electronic Remittance Advice, or ERA posting, represents the digital evolution of payment processing. Insurance companies transmit payment information electronically, allowing billing software to automatically import and post payments. This method dramatically reduces manual data entry, minimizes errors, and accelerates the payment reconciliation process.

Explanation of Benefits, or EOB posting, follows the traditional paper-based approach. Staff members receive physical EOB documents and manually enter payment details into the billing system. While more time-consuming, EOB posting remains necessary for payers who haven’t adopted electronic systems or when electronic transmission fails.

The shift toward automated payment posting through ERA has transformed many practices’ efficiency. What once took hours of manual entry now happens in minutes, freeing staff to focus on more complex billing issues.

Patient Payment Posting: The Human Touch

Patient payment posting carries its own unique challenges. Unlike standardized insurance payments, patient payments arrive through various channels—cash, checks, credit cards, online portals, and payment plans. Each requires proper documentation and security protocols.

The personal nature of patient payment posting demands sensitivity. When posting a patient’s payment, staff must clearly communicate what the payment covers, what remains outstanding, and whether the patient has met their deductible. Transparency here builds trust and reduces billing disputes.

Payment allocation becomes particularly important with patient payments. If a patient sends a partial payment, which services should it cover first? Most practices apply payments to the oldest charges first, but clear policies prevent confusion and complaints.

Manual Payment Posting vs Automated Payment Posting: Finding Balance

The debate between manual payment posting and automated payment posting isn’t about choosing one over the other—it’s about finding the right balance for your practice size and complexity.

Manual payment posting offers granular control. Staff members review every payment detail, catch unusual patterns, and can immediately address discrepancies. For small practices with manageable payment volumes, this hands-on approach maintains quality and accuracy.

However, manual posting has limitations. It’s time-intensive, prone to human error during repetitive tasks, and scales poorly as practice volume grows. A single transposed number can throw off account balances and create headaches down the line.

Automated payment posting leverages technology to handle routine, high-volume transactions. Modern billing software can read ERA files, match payments to claims, post amounts automatically, and flag exceptions for human review. This hybrid approach maximizes efficiency while maintaining oversight where it matters most.

Payment Reconciliation: Closing the Loop

Payment reconciliation serves as the quality control checkpoint in the payment posting process. This critical step verifies that all posted payments match actual deposits, all claims have been addressed, and no payments fell through the cracks.

Daily reconciliation compares the day’s posted payments against bank deposits. Weekly and monthly reconciliation reviews broader patterns, identifies trends in denials or underpayments, and ensures the accounts receivable aging report accurately reflects the practice’s financial position.

Effective payment reconciliation catches errors before they compound. A missed payment identified within days is easily corrected. That same missed payment discovered months later may require extensive research, reopening claims, and potentially writing off uncollectible amounts.

Payment Accuracy in Billing: The Foundation of Financial Health

Payment accuracy in billing determines whether your practice thrives or struggles financially. Inaccurate payment posting creates a cascade of problems: incorrect patient statements, inaccurate revenue reports, compliance risks, and damaged patient relationships.

Achieving payment accuracy requires multiple safeguards. First, establish clear standard operating procedures for every payment type. Second, implement regular audits to verify posting accuracy. Third, provide ongoing training so staff stay current with payer policies and software updates.

Technology aids accuracy but doesn’t guarantee it. Even automated systems require proper setup, regular updates to fee schedules, and monitoring for unusual posting patterns. The goal is creating a system where errors are rare exceptions rather than regular occurrences.

Applied Payments in Billing: Following the Money Trail

Understanding how applied payments in billing flow through your system provides crucial insights into practice performance. Each payment tells a story: which services generate reliable reimbursement, which payers process claims promptly, and where bottlenecks occur.

Applied payments data reveals patterns invisible in individual transactions. If one insurance company consistently underpays a specific procedure code, that pattern emerges through aggregate analysis. If patient payments for a particular service type lag, it might signal confusion about out-of-pocket costs.

Smart practices use applied payment data to optimize operations. They identify which contracted rates undervalue their services, which collection processes need improvement, and which administrative inefficiencies drain resources.

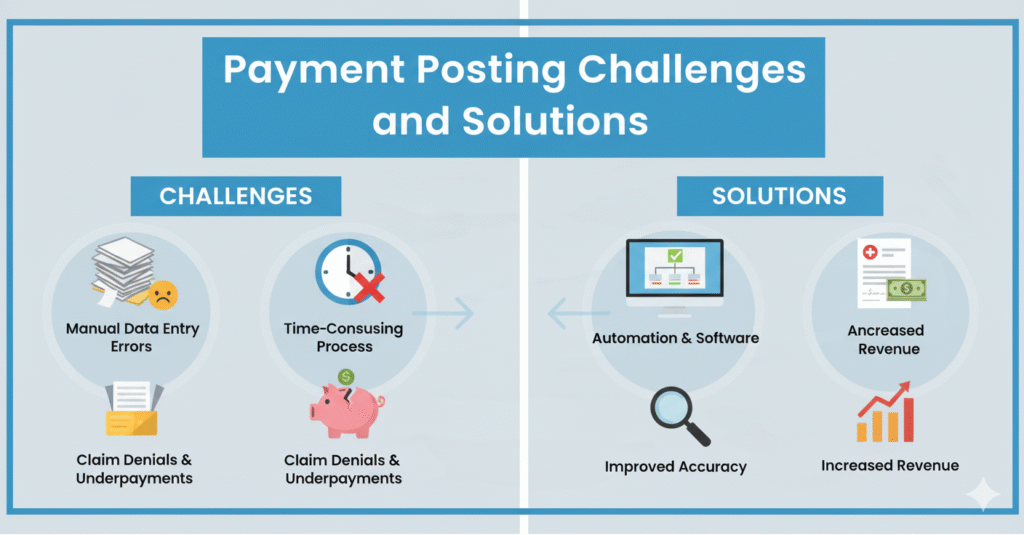

Common Payment Posting Challenges and Solutions

Real-world payment posting faces numerous obstacles. Payments arrive without adequate identification, requiring detective work to match them correctly. Insurance companies bundle multiple claims, making line-item posting complex. Payer websites crash during EOB downloads. Patients dispute charges already paid.

Overcoming these challenges requires robust systems and trained staff. Maintain detailed payment logs that track every dollar from receipt to posting. Develop relationships with insurance representatives who can clarify confusing remittances. Create patient communication templates that clearly explain charges and payments.

When posting errors occur—and they will—address them promptly and transparently. Document the error, correct it systematically, and implement process improvements to prevent recurrence. The worst approach is ignoring errors and hoping they resolve themselves.

Best Practices for Efficient Payment Posting

Excellence in payment posting doesn’t happen accidentally. It results from consistent application of proven practices.

Post payments daily, not weekly or monthly. Delayed posting creates cash flow blind spots and increases error risk. Daily posting keeps accounts current and enables rapid response to payment issues.

Train staff thoroughly on both manual and automated systems. Cross-train multiple team members so payment posting continues smoothly during vacations or absences. Regular refresher training keeps skills sharp as systems and payer policies evolve.

Separate payment posting duties from other billing functions when possible. This segregation of duties provides built-in checks and balances, reducing both intentional fraud and accidental errors.

Monitor key performance indicators: days in accounts receivable, percentage of claims posted within 24 hours, payment posting error rates, and denial trends. These metrics reveal process health and highlight improvement opportunities.

The Future of Payment Posting

Payment posting continues evolving as healthcare technology advances. Artificial intelligence now assists with payment matching, reducing manual review time. Blockchain technology promises more secure and transparent payment tracking. Patient payment portals integrate directly with billing systems, eliminating manual entry entirely.

Despite technological advances, the fundamental principles remain constant: accuracy, timeliness, and transparency. Technology should enhance these principles, not replace human oversight where judgment and experience matter.

Conclusion

Payment posting in medical billing may lack the glamour of patient care, but it provides the financial foundation that makes quality care possible. Every accurately posted payment strengthens your practice’s financial health, improves patient satisfaction, and ensures compliance with regulations.

Whether your practice handles payment posting in-house or outsources to specialists, understanding this process empowers better decision-making. It reveals where revenue leaks occur, which payers pose challenges, and how efficiently your practice converts services into income.

In an era of razor-thin healthcare margins, excellence in payment posting isn’t optional—it’s essential. The practices that master this critical process position themselves for long-term sustainability and growth, while those that neglect it struggle with persistent cash flow problems and financial uncertainty.

By implementing robust payment posting procedures, embracing appropriate automation, and maintaining relentless focus on accuracy, your practice can transform this behind-the-scenes function into a competitive advantage that supports your mission of delivering exceptional patient care.