When you see a CO-50 denial code on your billing paperwork, it feels like hitting a brick wall. Trust me, I’ve been helping medical offices deal with this headache for over a decade, and I know exactly what you’re going through.

Here’s what this code really means: the insurance company looked at your claim and decided they won’t pay because the service isn’t covered. Simple as that. But don’t worry—there are real ways to fix this and prevent it from happening

Understanding this denial isn’t just about recovering one payment; it’s about preventing future revenue losses and maintaining financial stability.

What Exactly Is the CO-50 Denial Code?

Think of it this way: you submit a claim to get paid. The insurance company looks at it and says, “Sorry, we don’t cover this service.”

That’s a claim denial. The “CO” part means Contractual Obligation under Group Code CO. In simple words? The doctor can’t charge the patient for this denied amount because of their contract with the insurance companies.

The EOB (Explanation of Benefits) will show this denial code along with other remark codes explaining why they won’t pay.

Common Scenarios Triggering CO-50 Denials

From my experience, these situations generate most CO-50 payment denials:

- Cosmetic procedures not deemed medically necessary by payer policies.

- Experimental treatments lacking sufficient evidence for coverage.

- Services exceeding plan limitations, such as therapy visit caps.

- Bundled procedures billed separately when payer-specific guidelines require combined billing.

Items the patient’s specific plan excludes, even if generally covered services.

The Revenue Cycle Impact You’re Experiencing

When CO-50 denials hit your practice, they create immediate financial strain. Unlike patient responsibility transfers, these denials mean zero reimbursement unless successfully appealed.

We have watched practices lose thousands monthly because they didn’t catch these denials during eligibility verification. The revenue cycle management team scrambles to identify underpayment detection issues, but by then, the damage compounds with additional remark codes and documentation requests.

Documentation Requirements for Resolution

Here’s what separates successful appeals from wasted effort: comprehensive supporting documentation.

Building Your Appeal Case

Your medical records must clearly demonstrate the clinical reasoning behind the service. I always recommend including:

- Detailed clinical notes explaining treatment justification.

- Relevant diagnosis codes supporting medical necessity.

- Procedure codes with proper modifiers.

- Prior authorization numbers if obtained.

- Precertification documentation when applicable.

The appeal process demands precision. Generic template letters rarely work because each insurance coverage contract has unique requirements.

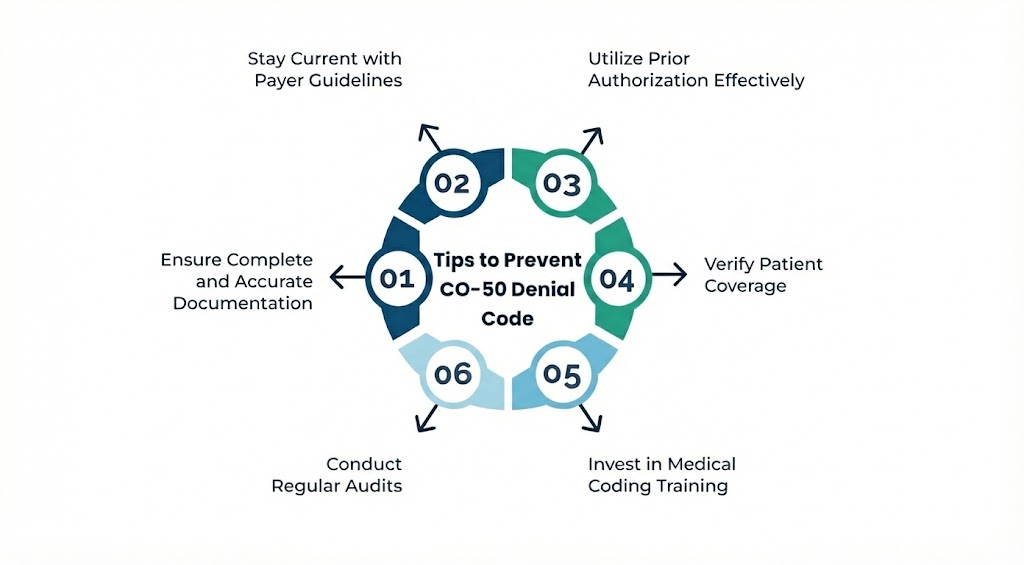

Prevention Strategies That Actually Work

After reviewing thousands of claim submissions, I’ve identified patterns that prevent CO-50 denials before they occur.

Front-End Verification

Invest time in eligibility verification before providing services. Call the payer directly for treatments that might trigger coverage questions. Don’t rely solely on automated systems.

Prior Authorization Excellence

Many providers skip pre-approval steps, assuming services are obviously necessary. Insurance companies don’t operate on assumptions. Obtain precertification for any questionable service, especially new treatments or high-cost procedures.

Coding Accuracy Matters

Medical coding errors frequently mask as coverage denials. Ensure your coding team understands how specific diagnosis codes pair with procedure codes under various payer policies. Regular internal audits catch these mismatches early.

Navigating Payer-Specific Guidelines

Each insurance carrier maintains different service coverage rules. What’s covered under Blue Cross may be denied by Aetna for identical services. It means that each insurance payer follows its own coverage rules, and what’s approved by one carrier may be denied by another.

To avoid unnecessary claim rejections,

I maintain a reference guide of major payer policies, updated quarterly. This prevents my team from submitting claims destined for denial. Healthcare providers cannot afford to learn payer preferences through rejected claims.

The Claim Resubmission Decision

Not every CO-50 denial warrants resubmission. Analyze whether you genuinely have grounds for reversal.

Ask yourself: Do I have documentation proving medical necessity within this plan’s parameters? Was there a coding error I can correct? Did coverage rules change between service date and claim processing?

If answers point to legitimate coverage exclusions, resubmission wastes time better spent on denial management for recoverable claims.

Patient Communication and Responsibility

When denials cannot be overturned, transparent patient communication becomes critical. Explain that the denial stems from their specific insurance coverage, not billing errors.

While you cannot bill them for CO-50 denials under contractual obligation terms, discussing service coverage limitations before treatment prevents uncomfortable conversations later.

Long-Term Denial Management Solutions

- Effective denial management requires systematic approaches, not reactive scrambling.

- Implement regular claim denial pattern analysis. If certain services consistently trigger CO-50 responses from specific payers, adjust your pre-service verification protocols. Track these patterns monthly to identify training opportunities for your team.

- Technology helps. Modern revenue cycle management software flags high-risk claims before submission, preventing denials rather than appealing them.

Moving Forward With Confidence

- Understanding the CO-50 denial code transforms it from a revenue mystery into a manageable challenge. Focus your energy on verification, documentation, and strategic appeals rather than blanket resubmissions.

- The healthcare providers who master these denials don’t just recover individual payments—they build systems preventing future losses. Your practice’s financial health depends on this precision.

Every remittance advice tells a story. Learn to read yours, and you’ll write a better financial future for your practice.