If you’ve ever received a hospital bill after surgery, you’ve likely encountered revenue code 0360 buried in the charges. This single line item can represent thousands of dollars, yet most patients and even some billing staff don’t fully understand what it covers.

In this article, we will focus on the revenue code 0360 , the general code for operating room serives.

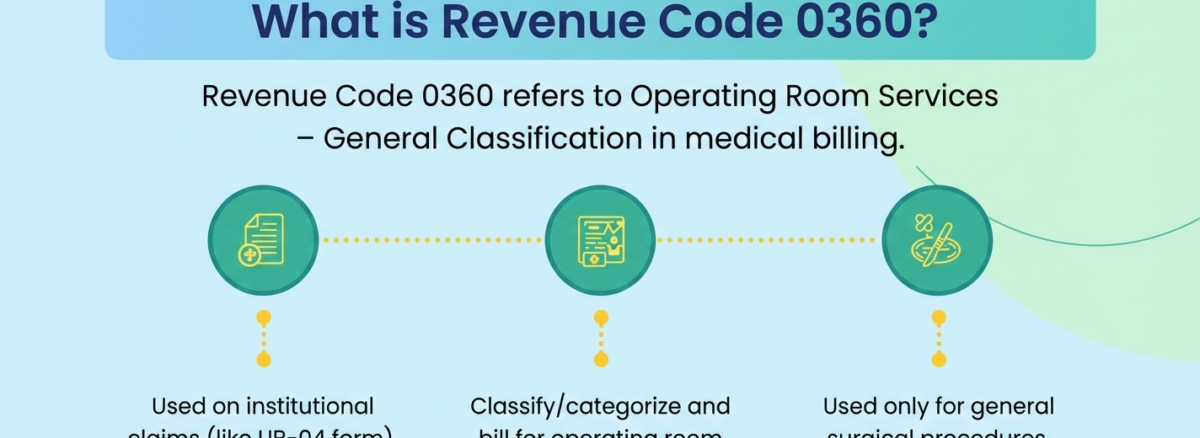

What is revenue code 0360?

It’s the institutional billing code used on the UB-04 claim form to capture facility charges for general operating room services. This four-digit code represents everything the hospital provides during your time in the main operating room, except the surgeon’s work itself.

10 years of experience in medical billing , We have watched many claims get denied for one simple reason, people misunderstood what a specific code actually includes. Knowing what revenue code 0360 truly represents isn’t just a technical detail. it plays a real role in whether hospitals receive proper reimbursement and whether patience can clearly make sense of charges on their bills.

Understanding the Core Definition of Code 0360

Revenue code 0360 falls under the 036X series, which is the general classification for all surgical services within hospital facility charges.

Think of it this way: when you’re wheeled into the operating suite, someone needs to bill for that space, the equipment humming around you, and the specialized staff keeping everything running. That’s exactly what this code does.

The code specifically captures charges for a full-service operating room equipped to handle major surgical procedures. We’re talking about the surgical environment itself, the infrastructure that makes modern surgery possible.

What Operating Room Services Does Revenue Code 0360 Cover?

Here’s where it gets practical. When a hospital uses revenue code 0360, they’re billing for:

The Physical Space and Time

Operating room time is expensive, and rightfully so. Every minute in the OR includes climate control, specialized air filtration, and maintained sterile supplies that meet rigorous standards.

Essential Personnel

Circulating nurses who coordinate everything during surgery and scrub techs who hand instruments to surgeons—these professionals are covered under this code. Their expertise keeps procedures running smoothly and safely.

Critical Equipment

The code 0360 includes OR‑level services for essential equipment like flicker‑free surgical lights, precisely calibrated anesthesia machines, vital‑sign monitoring systems, and sterilized surgical instruments.

OR Infrastructure

The surgical table, backup power systems, communication equipment, and countless other elements that make the operating room function—these are part of what you’re paying for.

What Revenue Code 0360 Does NOT Include

This is crucial for billing accuracy and avoiding claim denials

- Revenue code 0360 does not cover the surgeon’s professional fee. That’s billed separately using CPT codes. I’ve seen hospitals lose significant reimbursement because staff didn’t understand this distinction.

- It also excludes physician services of any kind—anesthesiologists, surgical assistants, and consulting doctors all bill independently.

Other Exclusions

- You leave the OR, different codes apply.

- Implants and prosthetics get separate line items. That artificial joint or surgical mesh isn’t part of the 0360 charge

- The code also doesn’t apply to minor surgery, which uses revenue code 0361 instead.

Pairing Code 0360 With Procedure Codes

Revenue codes never stand alone on hospital claims. They must pair with HCPCS codes or CPT codes that describe the actual procedure performed.

Think of it like this: the revenue code says “we used the operating room,” while the procedure codes say “here’s what we did there.”

For example, orthopedic surgery like knee surgery or hip replacement requires both the facility charge (0360) and the specific procedure code. The same applies to laparoscopic procedures, spinal fusion, or joint replacement.

Medical necessity ties everything together. Your operative report and clinical documentation must support why OR-level care was required. Without proper documentation requirements met, even correct coding won’t guarantee payment.

Documentation Requirements for Revenue Code 0360

Clean claims require specific documentation. After handling thousands of surgical claims, We can tell you exactly what payers want to see:

The Operative Report

This is non-negotiable. It must detail the procedure, findings, and any complications. Pre-operative documentation establishes medical necessity, while post-operative documentation confirms what was delivered.

Time Tracking

Start and stop times for operating room time must be clearly recorded in medical records. Some payers calculate facility charges based on duration, making accurate OR time logs essential.

Medical Necessity Support

Clinical documentation should explain why full operating room services were required rather than a procedure room or ambulatory setting.

We have watched a lot of hospitals blow their appeals because the operative notes failed to justify why OR‑level resources were needed. Tight, precise documentation is the key to protecting your legitimate reimbursement, don’t let sloppy paperwork cost you money you’ve earned.

Understanding Reimbursement for Revenue Code 0360

Hospital claims using revenue code 0360 get paid through various methodologies depending on the setting and payer.

Outpatient Settings

- Medicare OPPS (Outpatient Prospective Payment System) uses APC or Ambulatory Payment Classification. The procedure performed determines which APC applies, and the APC sets the payment rate.

- Contract rates with private insurance companies vary significantly. Blue Cross Blue Shield, UnitedHealthcare, Aetna, and Cigna all negotiate different fee schedules with hospitals.

Inpatient Settings

DRG or Diagnosis-Related Groups bundle all facility charges, including OR services, into one payment. The revenue code still appears on the claim for tracking, but it doesn’t directly determine reimbursement rates.

Other Payers

Medicare and Medicaid follow federal and state fee schedules. Workers’ compensation has its own payment methodologies. Commercial payers negotiate individually.

Understanding your contracts is critical. The same procedure can reimburse differently across payers based on contract rates and payment methodologies.

Common Procedures Using Revenue Code 0360

In our experience, certain specialties generate the majority of 0360 charges:

Orthopedic Surgery

This specialty dominates OR utilization. Procedures requiring this code include everything from complex trauma cases to elective joint replacements.

General Surgery

Emergency surgery, trauma care, and complex abdominal procedures all require full operating room services.

Specialty Procedures

Cardiovascular surgery, neurosurgery, thoracic procedures—these all need the full resources captured by revenue code 0360.

The key differentiator: does the procedure require the complete surgical environment with all monitoring systems, specialized equipment, and full surgical team? If yes, 0360 applies.

How to Avoid Claim Denials With Revenue Code 0360

Revenue cycle management for surgical services requires attention to detail. Here’s what causes most denials—and how to prevent them:

Accurate Coding

Match the revenue code to the actual service location. Using 0360 for a procedure room case will trigger denials fast.

Complete Documentation

When you send a claim without attaching the operative notes or other supporting medical records, the payer will usually ask for the missing docs, which slows down payment or can even lead to a denial. Make sure every claim is backed by full, detailed documentation that justifies the services billed.

Proper Pairing

The revenue code must align with appropriate procedure codes. Mismatches raise red flags during claim processing.

Billing Accuracy

Duplicate charges, incorrect units, or missing modifiers all impact clean claims rates.

Compliance

Following payer-specific guidelines isn’t optional. Each commercial payer may have unique requirements beyond standard medical billing rules.

Audit Protection

Maintaining thorough documentation provides audit protection when payers review claims retrospectively.

Best Practices for Using Revenue Code 0360

After years of watching billing departments struggle—and succeed—here’s what works:

- Train staff thoroughly on what constitutes OR-level services versus other settings. The distinction seems simple until you’re coding an edge case at 4 PM on Friday.

- Implement checks during claim submission to verify documentation is attached and complete.

- Review claim denials systematically. Patterns emerge that reveal training gaps or documentation issues.

- Stay current with payer requirements. Contract rates and coverage rules change regularly, especially with Medicare and Medicaid.

- Create clear protocols for edge cases. When does a procedure require 0360 versus 0361? Having written guidelines prevents inconsistent coding.

The Real Impact of Revenue Code 0360 on Healthcare Billing

- This single code represents billions of dollars in hospital revenue annually. For patients, it’s often the largest facility charge on their bill after a surgical procedure.

- For hospitals, accurate use of revenue code 0360 directly impacts financial health. Under coding leaves money on the table. Over coding invites audits and compliance issues.

- From a healthcare system perspective, proper use of this code ensures appropriate reimbursement for expensive OR infrastructure while maintaining transparency in hospital facility charges.

Final Thoughts on Revenue Code 0360

Understanding institutional billing codes like code 0360 bridges the gap between clinical care and financial operations. Whether you’re a patient trying to understand your bill, a coder ensuring billing accuracy, or a revenue cycle manager protecting reimbursement, knowing exactly what this code represents matters.

The operating room remains one of the most expensive areas of any hospital. Revenue code 0360 ensures that facilities receive appropriate payment for providing this critical surgical environment.

Remember: this code captures the facility’s resources—the room, equipment, supplies, and support staff. The surgeon’s expertise is billed separately. Together, they represent the complete picture of surgical care.