If you’ve ever worked in healthcare billing, you’ve probably heard the terms “verification” and “validation” tossed around like they’re interchangeable. But here’s the thing—they’re not. Understanding how to differentiate between verification and validation in medical billing can be the difference between smooth claim processing and a mountain of denials eating into your revenue.

Let’s break down these two critical processes and why mixing them up could cost your practice thousands of dollars.

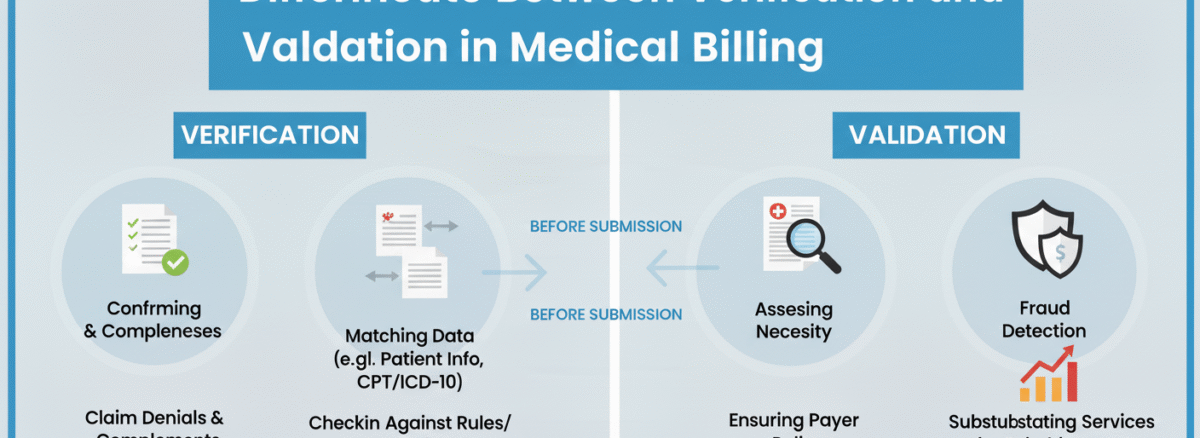

How to Differentiate Between Verification and Validation in Medical Billing

Think of verification as asking “Are we doing things right?” and validation as asking “Are we doing the right things?” That might sound like wordplay, but in the medical billing process, this distinction matters enormously.

Verification happens upfront. It’s about confirming that patient information is correct and that insurance coverage actually exists before services are rendered. Validation, on the other hand, comes later in the healthcare billing workflow—it ensures that the claim you’re submitting matches what actually happened during the patient encounter.

Insurance Verification: Your First Line of Defense

Eligibility verification is where the revenue cycle management process truly begins. Before a patient even walks through your door, your front desk team should be checking whether their insurance is active, what services are covered, and if prior authorization is needed.

This data verification step catches problems early. Imagine scheduling a procedure only to discover afterward that the patient’s insurance lapsed last month. That’s a billing nightmare you could have avoided with proper verification protocols.

The difference between insurance verification and claim validation starts here—verification protects you before services are delivered, while validation protects you before claims are submitted.

Claim Validation: The Quality Control Checkpoint

Once services are rendered and coded, claim validation steps in as your quality control mechanism. This process examines whether the codes used accurately reflect the documentation, whether the diagnosis supports the procedures billed, and whether all required information is present for clean claim submission.

Validation asks tough questions: Does this diagnosis code justify this procedure? Are the modifiers correct? Is the provider information accurate? Think of it as your final inspection before sending the claim out into the world.

Why You Can’t Skip Either Process

Some practices try to cut corners by focusing heavily on one process while neglecting the other. That’s like locking your front door but leaving your windows wide open.

Strong eligibility verification prevents patients from receiving services they can’t pay for. Thorough claim validation ensures that billable services actually get paid. Together, they form a powerful denial prevention strategy that keeps your revenue flowing.

When you differentiate between verification and validation in medical billing and implement both properly, you’re building a dual defense system. Verification catches issues before they become your problem, while validation ensures you don’t create new problems through billing errors.

The RCM Connection: How These Processes Fit Together

In revenue cycle management, verification and validation work as complementary phases rather than competing priorities. RCM verification vs validation isn’t about choosing one over the other—it’s about understanding where each fits in your workflow.

Your healthcare billing workflow should flow like this: verification happens during scheduling and registration, validation happens during claim preparation, and both work together to maximize claim accuracy and minimize denials.

Practices that master this distinction see cleaner claims, faster payments, and fewer headaches from insurance companies asking for additional information or rejecting claims outright.

Common Mistakes That Blur the Lines

Many billing departments make the mistake of validating information that should have been verified earlier. You shouldn’t be discovering insurance eligibility issues during claim preparation—that’s too late.

Similarly, some teams over-verify and under-validate, spending enormous effort confirming coverage but then submitting claims riddled with coding errors. Balance matters.

Another pitfall? Treating these as one-time events rather than ongoing processes. Insurance coverage changes. Patient information updates. Your verification and validation procedures need to happen consistently, not just occasionally.

Practical Steps to Strengthen Both Processes

Start by creating clear checkpoints in your workflow. Designate specific staff members responsible for verification tasks and others for validation duties. This prevents confusion about who’s handling what.

Invest in technology that supports both functions. Many practice management systems can automate eligibility checks and flag potential claim issues before submission. These tools don’t replace human oversight, but they catch errors that tired eyes might miss.

Train your team to understand the difference between insurance verification and claim validation. When everyone knows which questions to ask and when to ask them, your entire revenue cycle runs more smoothly.

The Bottom Line on Verification and Validation

Learning to differentiate between verification and validation in medical billing isn’t just academic exercise—it’s practical wisdom that protects your bottom line. Verification confirms you’re starting with accurate information. Validation ensures you’re submitting claims that will actually get paid.

Get both right, and you’ll see fewer denials, faster reimbursements, and less staff time wasted on rework. Miss either one, and you’re leaving money on the table while frustrating your team and your patients.

The medical billing process has enough challenges without confusing these two essential functions. Now that you understand how they differ and why both matter, you can build a more efficient, more profitable revenue cycle for your practice.